When it comes to securing your future, insurance can be an invaluable tool. It offers a financial cushion against unexpected events, providing peace of mind and stability in uncertain times.

There's a diverse range of insurance options available to suit individual needs. From medical insurance to auto coverage, homeowners coverage, and business insurance, there is a policy to safeguard specific risks.

- Comprehending your unique needs is the first step in selecting the right insurance coverage.

- Investigating different insurance providers and comparing options can help you find the best value for your money.

- Don't hesitate to speak with to an insurance agent or financial advisor to receive personalized guidance.

By taking the time to learn about insurance options and making informed decisions, you can strengthen your financial future and live with greater peace of mind.

Securing Your Future: Crafting a Robust Business Framework

A thriving business demands meticulous financial planning. It serves as the cornerstone of success, guiding your decisions and ensuring long-term stability. By developing a comprehensive investment roadmap, you can effectively manage resources, discover opportunities, and mitigate risks.

A robust financial plan should comprise a clear understanding of your business's objectives, earnings streams, and expenses. It in addition involves setting realistic spending limits, observing key financial data points, and adapting your strategy as needed.

- Establish a clear understanding of your business's financial health.

- Determine realistic financial goals and objectives.

- Monitor your cash flow regularly.

- Regulate expenses effectively.

- Explore funding options for growth and expansion.

Charting the Banking Landscape: Choosing the Right Institution

In today's dynamic financial scene, selecting the optimal banking institution can substantially impact your financial well-being. With a proliferation of options available, from established banks to online alternatives and credit unions, it's essential to thoroughly evaluate your needs and preferences before making a decision.

Consider factors such as portfolio fees, interest rates on deposits and loans, customer service quality, branch availability, and online banking capabilities. Create a compilation of your requirements, and then research different institutions that correspond with your criteria.

Remember, the best banking institution for one person may not be the perfect fit for another. Take your time, explore your options thoroughly, and choose an institution that empowers you to attain your financial goals.

Trading Strategies for Growth and Security

Securing your financial future requires a click here well-crafted strategy. Finding the optimal balance between growth potential and risk mitigation is vital. A diversified method that spans various asset classes, such as equities, bonds, and real estate, can help mitigate risk. Consider your personal circumstances, including your investment goals, before choosing investments. Regularly assess your portfolio performance and make adjustments as needed to stay aligned with your objectives. Consulting a qualified financial advisor can provide valuable insights tailored to your specific needs.

- Develop a comprehensive financial plan that outlines your investment goals and risk tolerance.

- Spread your investments across different asset classes to reduce overall risk.

- Evaluate potential investments thoroughly before committing capital.

- Explore tax-advantaged investment options such as 401(k)s and IRAs.

- Stay informed about market trends and economic developments that may affect your investments.

Unlocking the Secrets of Finance: Essential Terms Defined

Navigating money matters can often feel like traversing a complex labyrinth. , Nevertheless with a clear understanding of core financial principles, you can confidently tackle your money and achieve their financial goals. Let's demystify some key terms that form the bedrock of financial literacy.

- Asset Management: The process of putting money to work with an aim of generating returns over time.

- Expense Tracking: Creating a structured plan for how to allocate your income, ensuring you meet your expenses and save future objectives.

- Interest: The price associated with borrowing money or the profit earned from lending it.

Remember, these are just a few fundamental ideas that can help you gain a stronger grasp of finance. Continue exploring to build your financial knowledge and make savvy decisions about your money.

Mitigating Risk: The Importance of Comprehensive Insurance Coverage

In today's volatile world, risks lurk around every corner, potential threats to your financial well-being and peace of mind. A comprehensive insurance policy acts as a crucial safety net, delivering protection against these unforeseen events. From unexpected accidents and health emergencies to natural disasters and property damage, a diverse insurance portfolio can help you navigate these challenges with greater confidence.

It's essential to meticulously evaluate your needs and select an insurance plan that addresses your specific requirements. A advisor can guide you through the process, helping you understand the different types of coverage available and selecting the optimal policy for your situation.

Remember, acquiring in comprehensive insurance is not just about reducing financial risk; it's also about protecting your future and providing yourself the opportunity to focus on what truly matters.

Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Christy Canyon Then & Now!

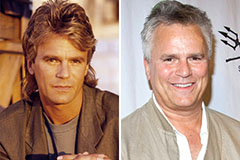

Christy Canyon Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!